Tenure and interest rate combinations for our fixed deposit account:

| Tenure | Interest Rate (% p.a.) |

|---|

|

1 month

|

1.80

|

|

2 months

|

1.85

|

|

3 months

|

1.95

|

|

4 months

|

2.00

|

|

5 months

|

2.00

|

|

6 months

|

2.05

|

|

7 months

|

2.05

|

|

8 months

|

2.05

|

|

9 months

|

2.05

|

|

10 months

|

2.05

|

|

11 months

|

2.05

|

|

12 months

|

2.05

|

|

13 - 35 months

|

2.10

|

|

36 - 47 months

|

2.15

|

|

48 - 59 months

|

2.15

|

|

60 months

|

2.15

|

*Effective from 10 November 2025

All interest / dividend rates quoted may change without prior notice. Please contact the nearest Maybank branch for the latest rates

Computation of Interest

Computation of Interest shall be based on the number of days within the term of the deposit.

Unclaimed Moneys Act 1965

In accordance with the Unclaimed Moneys Act 1965 (revised 1989) the money in the Fixed Deposit account under Automatic Renewal shall be classified as Unclaimed Moneys if the Fixed Deposit account is not operated for a period of seven (7) years from date of deposit or date of last transaction, whichever is later.

Terms and Conditions on Fixed Deposit (FD) Premature Withdrawal

With effect from 1 January 2019 (“Effective Date”), the new premature withdrawal rule for all existing, renewed and new placements of Conventional Fixed Deposit are as follows :-

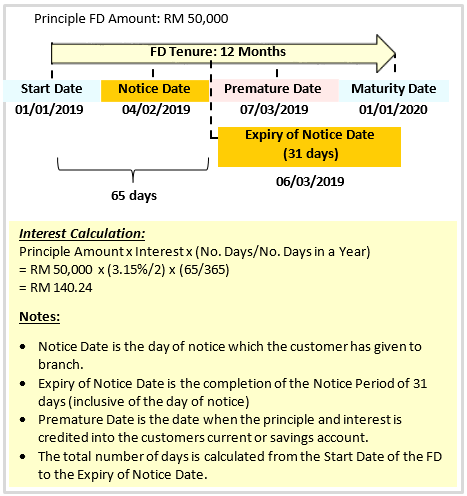

Immediate Fixed Deposit Premature Withdrawal (Without 31 days’ Notice Period)

- No interest shall be paid on any immediate fixed deposit premature withdrawal (Without 31 days’ Notice Period) that has not completed its respective full tenure period.

- Example of Immediate FD Premature Withdrawal Calculation:

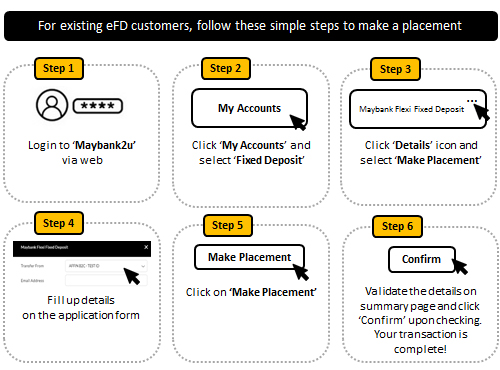

Fixed Deposit Premature Withdrawal (With 31days’ Notice Period)

- 50% of the contracted interest rate is payable when a ‘Notice Period’ of 31 days (inclusive of the day of notice) is given by the customer at the branch.

- A notice in writing with the intention to premature the FD (With Notice Period) must be given to the branch.

- Based on customer’s notice, the principal amount and the accrued interest will be credited on the day 32nd into customer’s desired current or savings account available at the Bank.

- Customer must have a current or savings account with the Bank.

- The accrued interest will be calculated daily up to the end of the ‘Notice Period’.

- Once the notice is given, the customer is not allowed to change the instructions and uplift the Fixed Deposit until the end of the ‘Notice Period’.

- Example of FD Premature Withdrawal Calculation:

Note:

For pre-mature uplifts, the interest paid upfront (if applicable) will be deducted from the principal amount.

Click here for more information on the New Premature Withdrawal Rule for Conventional Fixed Deposit

Click here for Conventional Frequently Asked Questions (FAQ)

Click here for Terms and Conditions Governing Banking Accounts

Click here for Sample Notice for FD Premature Withdrawal with 31 days' Notice Period